In an unprecedented move to combat the menace of black money,

Unaccounted wealth accounts for as much as one-fifth of the Indian economy, according to Ambit Capital. Property and gold will see the biggest negative impacts as these are usually considered the best way to deploy such money, CLSA said in a note to clients. Property prices could fall 10 percent to 20 percent while the impact on land prices will be bigger, CLSA said.

As per my previous blog where I shared the view that Government shall lose out on wealth not accounted and would have been great increase in reserves had the scheme combined with VDIS or Infra Bonds. Few More voices to that

In my last blog i had suggested of 0% coupon rate Infrastructure bonds. In current scenario if the person deposits in bank with no source of income he shall be subjected to 200% tax penalty and may be harassed in future. To avoid that evaders might dump money rather than reporting.

Now if the Government had considered Infrastructure bonds; Check the gain to government and loss to tax evader. However he would have still taken the option with both hands for no fear of prosecution. Figures illustrated as under

I was questioned on my earlier blog; What if the terrorists' money goes into Infra Bonds. Good for India. Terrorists would never block their money under the government for 10 years

I was also countered that the government gave enough options and time under VDIS. I completely agree but what if it was a combination of the two?

It is still not too Late. As far as i know, For our respected Prime minister, our country's wealth is more important than his ego. He can still save the wealth by looking at Infra Bonds as an option rather than notes being burnt as Garbage

Honourable Prime Minister, Narendra Modi has announced

demonetisation of the INR 500 and INR 1,000 notes with immediate effect from November 8 Midnight. The initiative seeks to control corruption, fake currency circulation and terror financing.

While the move will see initial chaos and short term pain, I believe it is structurally positive as:

- It has obliterated black money;

- A chunk of RBI’s liability will get erased which could be used to rein in fiscal deficit/PSU bank recap/push economic reforms;

- Tax-to-GDP ratio will spurt fetching rating upgrades;

- The shift in trade from unorganized to organized sector will see heightened acceleration.

Below is brief summary of long term and short term impact of the move (source EDELWEISS)

In this blog i shall focus only on real estate. My view on real estate sector is as under :

Medium to long term: Positive

Short term: Marginally Negative

Overall impact: Positive on long to medium term basis.

In short term, the government’s

initiative on black money should be somewhat negative

for the sector.

Demand impact: I believe demand would be negatively

impacted in tier 2/3 and smaller

cities which are dominated by smaller developers and

where cash component in real estate

transactions is significant. In metros/tier 1 cities,

the proportion of cash component in real

estate transactions has declined significantly (not

>20-30%) and limited mainly to few

smaller players. Importantly, most the prominent

developers in these cities are now

accepting payments largely through cheques, with little

cash component. Hence, in metros

demand for smaller/unorganised players would be impacted

to some extent, we do not see

much impact on demand for large/organised players.

Supply impact: Amidst uncertain demand scenario, expect some slowdown in new

launches in residential segment in short term. However,

this would be limited to

smaller/unorganised players and mainly in smaller

markets.

Pricing impact: Do not expect meaningful price

correction in major markets or for

larger/organized developers. The smaller players may

witness drop in demand and may not

gain much by reducing prices.

Shift to organised/larger players: I see a shift in

demand to larger/organised developers

from the smaller/unorganised players as the former

mainly accept cheque payments with

minimal cash component. This, along with the Real Estate

Bill will prove to be a deterrent

for smaller/one-time developers looking to park their

excess unaccounted funds by entering

the real estate market.

Stock impact: In medium to long term, expect the

listed players operating in large

markets to benefit. Those operating primarily in smaller

cities could be hurt. While sales

could be impacted in short term, see little impact on

earnings, given these are primarily

driven by sales already locked in. Oberoi Realty, Godrej

Properties, Sobha, Brigade

Enterprises

and Sunteck Realty could be likely beneficiaries.

Unaccounted wealth accounts for as much as one-fifth of the Indian economy, according to Ambit Capital. Property and gold will see the biggest negative impacts as these are usually considered the best way to deploy such money, CLSA said in a note to clients. Property prices could fall 10 percent to 20 percent while the impact on land prices will be bigger, CLSA said.

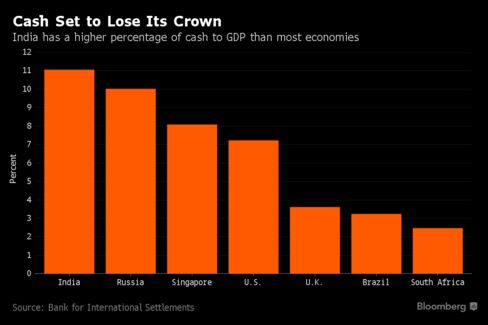

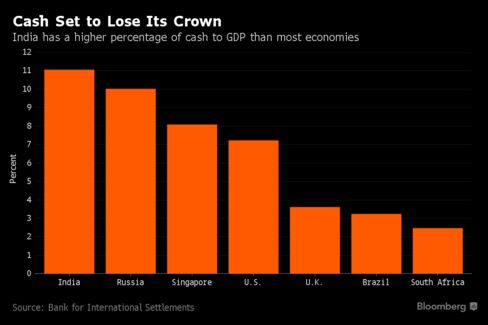

Source: Bloomberg

As per my previous blog where I shared the view that Government shall lose out on wealth not accounted and would have been great increase in reserves had the scheme combined with VDIS or Infra Bonds. Few More voices to that

“It is hard to estimate how much of the currency will not be exchanged, i.e., black money that would become worthless,” Mumbai-based Neelkanth Mishra said in the note. “Not all of it is kept in cash under the mattress, but even if this was 20 percent, it would mean three trillion rupees of wealth destroyed.”

The government’s clampdown on black money by voiding Rs 500 and Rs 1,000 notes could think wealth destruction could be pretty meaningful, according to a former Reserve Bank Governor. Back in 1978, when the government resorted to a similar demonetization, about 85 percent of currency didn’t come back into the system in terms of currency exchange, said C Rangarajan. Considering that number, he added, “I think wealth destruction could be pretty meaningful this time”.

In my last blog i had suggested of 0% coupon rate Infrastructure bonds. In current scenario if the person deposits in bank with no source of income he shall be subjected to 200% tax penalty and may be harassed in future. To avoid that evaders might dump money rather than reporting.

Now if the Government had considered Infrastructure bonds; Check the gain to government and loss to tax evader. However he would have still taken the option with both hands for no fear of prosecution. Figures illustrated as under

I was questioned on my earlier blog; What if the terrorists' money goes into Infra Bonds. Good for India. Terrorists would never block their money under the government for 10 years

I was also countered that the government gave enough options and time under VDIS. I completely agree but what if it was a combination of the two?

It is still not too Late. As far as i know, For our respected Prime minister, our country's wealth is more important than his ego. He can still save the wealth by looking at Infra Bonds as an option rather than notes being burnt as Garbage

This comment has been removed by the author.

ReplyDeleteOne missing point of counterfeit notes ?

ReplyDeleteUnaccounted money includes that as well, as during collection it will be filtered out.

Having done that as per records govt. can replenish balance by printing and bring it back to circulation through various development project ? I am not expert but feel can see it this way as is what GOI (PM) intention may be. No idea how these comments may have effect on observations made in above blog.

No steps announced for moving to mobile banking like PayTM or others.

ReplyDeleteNow reducing deposit rates will be another blow to small players!

Will this make NPAs more secured is not yet established?